Poland – Country Review

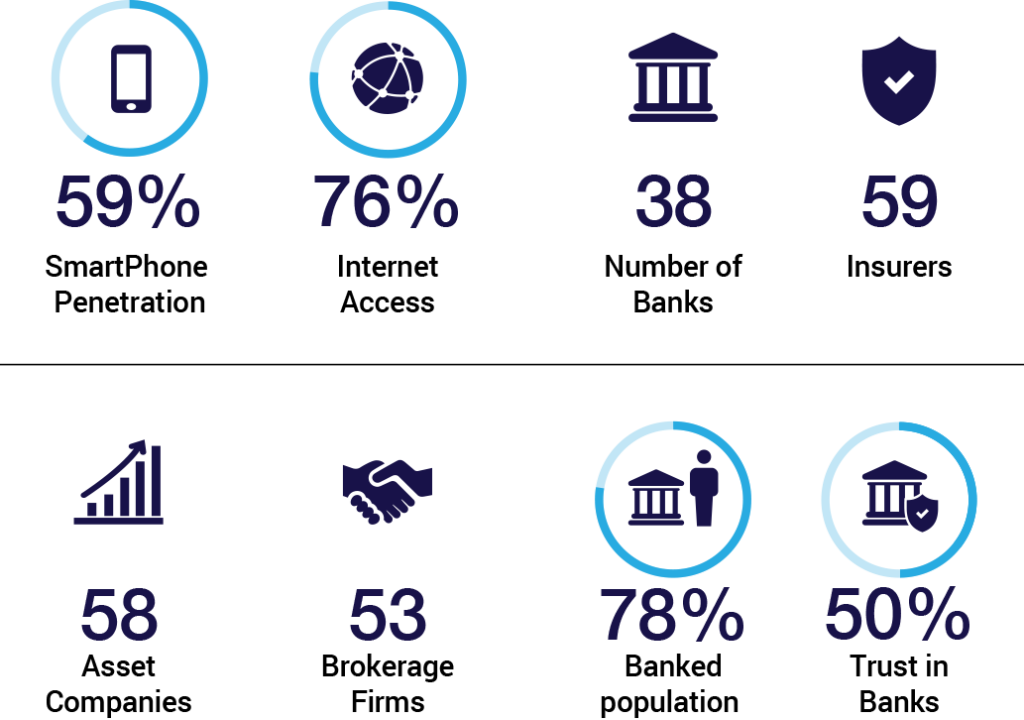

Quick Stats

Market Outlook

- The Polish banking sector is consolidating: there have been 10 major bank mergers since 2009

- The top five banks represented 50% of the sector’s total assets in 2014 and 64% of net pro ts34

- Two thirds of the banking assets in the country belong to foreign-owned banking groups (four of the five biggest banks are part of international banking capital groups)

- PZU, the biggest Polish insurer, accounts for 30% of the sector’s total gross premiums and 66% of net profits (2014)36

- Top five insurers (life and non-life) made up 57% of total sector gross premiums in 2014 and 88% of net profits (four of the five biggest insurers are part of international financial capital groups)37

- Banks have a strong role as insurance intermediaries in the life segment (bank assurance generated 38% of GWP in the life segment in Q3 201538, but its share is decreasing)

Regulatory Environment

- The major financial regulatory authorities include: National Bank of Poland, Polish Financial Supervision Authority, Banking Guarantee Fund

- The insurance sector’s authorities and regulators include: Polish Financial Supervision Authority, The Polish Insurance Association

Future Development

- Banking incomes are under pressure (and forecast to decrease in years to come) due to:

Falling interest rates

• A potential law to convert Swiss franc mortgages (could mean up to EUR 10 billion in losses for the banking sector) - Implementation of the bank levy:0.44% of a bank’s assets – applicable to banks with assets exceeding PLN 4 billion (~EUR 1 billion)

- Increased obligatory contributions to the Banking Guarantee Fund (the consequence of defaults by several co-operative banks)

- As a result, banks have started to seek additional revenue in increased fees and commissions (eg on mortgages, current accounts, ATM withdrawals etc.)

The expected challenges include:

• Income levels of major insurers will be affected by the introduction of additional tax (0.44% on assets over PLN 2 billion)- New regulations, such as the implementation of:

Recommendation U (regulating the banc assurance market), restrict banks from being the insurer and the insured at the same time and require banks to give customers transparent product information along with freedom of choice regarding the insurer.

SWAT Analysis

Strengths

- Poland has weathered the economic crisis fairly well compared to its European neighbours. Since the end of the financial crisis, GDP has increased each year by 3.1% on average (2009 – 2015).

- Companies bene t from the large domestic market – Poland is the sixth-largest EU country in terms of population.

- The Polish economy is fairly competitive (ranked 41st and as the third best CEE country according to the Global Competitiveness Report).

- Gross hourly labour costs in Poland are three times lower than the EU average

(EUR 8.4 vs. EUR 24.6). - The ratio of non-performing loans (NPL) is stable (between 4.3% and 5.2% between 2009 – 2015).

- Poland is attractive to foreign investors(FDI net in ow totalled 3.2% of GDP in 2014).

- Poland rose in the “Doing Business” ranking from 76th in 2009 to 25th in 2015.

- Businesses can be registered in a one-stop shop at the National Court Register.

- Government has set up 14 Special Economic Zones, locations dedicated to investors where business activity is coupled with preferential conditions such as tax relief and the strong support of municipalities.

Weaknesses

- The non-observed economy is estimated to stand at a high 15.4% of GDP.

- Poland is ranked 46th in the Global Innovation Index (among EU countries, only Romania is ranked lower).

- Real GDP per capita (adjusted to re ect purchasing power) is only 68% of the EU average and is below the Czech Republic, Slovakia and Slovenia.

- Poland has one of the lowest savings levels in CEE (1.9% of gross disposable income).

- There is a relatively low usage of cloud services both by individuals and enterprises (respectively the third and second lowest in the EU).

- Usage of online sales channels by SMEs is below average (EU – 14.5%, PL – below 10%).

- Penetration of xed and wireless broadband is fairly low compared to other OECD countries (18.5% vs 28.8% for xed and 55% vs 85.5% for wireless).

- The activities of regulatory authorities can hamper innovation in the nancial sector

(in areas including cloud computing, non-bank personal lending and bancassurance).

Opportunities

- The high level of business-cycle synchronisation with the advanced German economy, due to an integrated supply chain (exports to Germany accounted for 26% of all Polish exports in 2014).

- Poland is the largest bene ciary of EU support. The EU has allocated EUR 82.5 billion to Poland over the 2014–2020 period.

- There is a possibility of obtaining dedicated public aid, granted on the basis of an agreement between the Minister of the Economy and

the investor. Companies planning to invest in seven selected industries, including R&D and biotechnology sectors, can apply for support. - Numerous domestic FinTech start-ups and mature companies are operating both in Poland and abroad.

Threats

- The working-age population is estimated to be set to decrease by 35% between 2013 and 2060 in Poland, and by just 13% in the EU.

- The rural population accounts for around

40% of all citizens; this can slow the growth of innovative banking services due to the different preferences of customers (many of whom are clients of co-operative banks). - Poland has one of the lowest shares among OECD members of ICT specialists among the working population (2.4% vs the average 3.6%).

- The number of IT students has fallen (from 100,000 to 70,000 between 2006 and 2013).

+381 11 33 44 147

+381 11 33 44 147

Thanks, great article.